Nvidia Arm Investment Bank

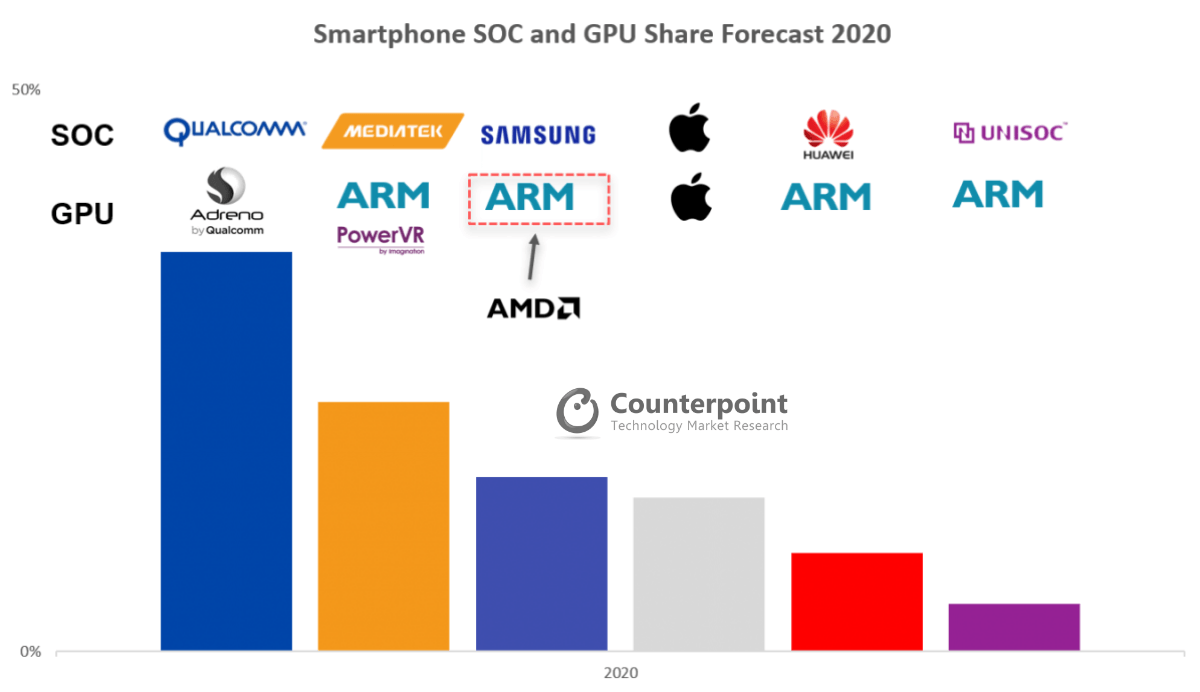

The nvidia deal part of a series of asset sales by mr son whose group has been shaken by soured investments and the covid 19 pandemic has raised concerns it will threaten arm s role as a neutral supplier in the industry.

Nvidia arm investment bank. In the meantime the job is about making nvidia s investment. Nvidia buys softbank s arm holdings for 40 billion softbank has agreed to sell the uk based arm holdings to us chipmaking company nvidia for 40 billion a statement released on sunday confirmed. As part of the acquisition which represents the largest ever deal in the semiconductor industry nvidia will pay softbank 21 5 billion in stock and 12 billion in cash. Ceo of arm said.

A merged nvidia arm would result in a market at least 10 times larger than today s mobile phone or cloud computing market. Timid fund managers preferred to bank a quick 40. Nvidia will issue an additional 1 5 billion in shares to arm s employees then pay up to 5 billion in cash or common stock to softbank if arm achieves certain financial targets. However the acquisition of arm by nvidia of which softbank is a former shareholder is being characterised by the graphics giant as a means to bolster its presence in the rapidly growing artificial intelligence ai computing space.

Arm and nvidia share a vision and. And also the risk to the promise of oodles of investment in arm s. Arm was purchased by softbank in 2016 in a move that then caused shockwaves in the uk tech sector. It two major investment bets wework and.

Nvidia had a market valuation of roughly similar to that of arm s at the time of the 2016 deal but now trades with a market value of 300 billion or roughly 10 times the amount softbank paid. According to research from investment bank jefferies. Chipmaker nvidia has agreed to buy arm holdings a designer of chips for mobile phones from softbank in a deal worth 40 billion the companies announced sunday.